It depends on the underlying fixed asset’s carrying value and the sales proceeds received for the transaction. If the sale proceeds exceed the asset’s carrying value, it generates income for the company. These are tangible assets that help companies generate revenues and run the business. These assets also come with substantial costs and require companies to use depreciation to convert them into expenses.

Reverse the Effect of Gains and/or Losses

The loss recognized from the sale should be added back to net income in the operating activities section and proceed as a cash inflow for investing activities. It’s a positive adjustment in the operating section because it reduced net income but had no effect on cash flow. The beginning and ending balances that appear on the comparative balance sheet are the same as those in the Equipment ledger’s debit balance column on January 1 and September 12, respectively. The $10,000 credit entry is the cost of the equipment that was sold on April 3. The $171,000 debit entry in the debit column is the cost of the equipment that was purchased on September 12. The sale results in a cash inflow, and the purchase results in a cash outflow.

Reconciling the Increase in Cash from the SCF with the Change in Cash Reported on the Balance Sheet

This would impact the cash flows from investing activities section since there would be an additional cash receipt. As a different possibility, an asset account such as Equipment may have experienced more than one transaction rather than just a single purchase. Using the same comparative balance sheet information as in the previous example, note that the information to its right in item d. The Statement of Financial Accounting Standards No. 95 encourages use of the direct method but permits use of the indirect method. Whenever given a choice between the indirect and direct methods in similar situations, accountants choose the indirect method almost exclusively. The American Institute of Certified Public Accountants reports that approximately 98% of all companies choose the indirect method of cash flows.

- This year your company decided to sell the land and instead buy a building, resulting in the following transactions.

- In both cases, theincreases can be explained as additional cash that was spent, butwhich was not reflected in the expenses reported on the incomestatement.

- The company receives a trade-in allowance for the old asset that may be applied toward the purchase of the new asset.

- Cash flow from operating activities will increase when prepaid expenses decrease.

What is a Cash Flow Statement? What Are The Three Sections?

Consequently, companies can include the sales proceeds in the cash flow statement. Investing and financing transactions are critical activities of business, and they often represent significant amounts of company equity, either as sources or uses of cash. Common activities that must be reported as investing activities are purchases of land, equipment, stocks, and bonds, while financing activities normally relate to the company’s funding sources, namely, creditors and investors.

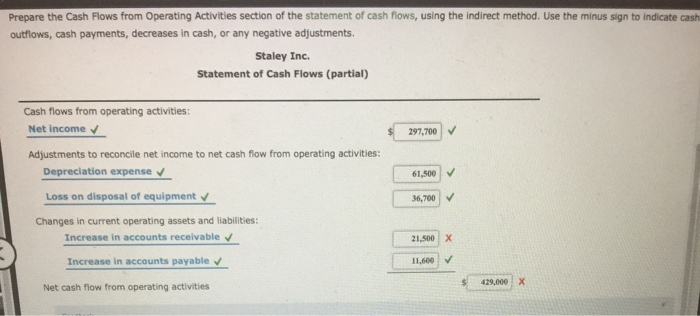

You can calculate these cash flows using either the direct or indirect method. The direct method deducts from cash sales only those operating expenses that consumed cash. This method converts each item on the income statement directly to a cash basis. Alternatively, the indirect method starts with accrual basis net income and indirectly adjusts net income for items that affected reported net income but did not involve cash. In both cases, these increases in current liabilities signify cash collections that exceed net income from related activities. To reconcile net income to cash flow from operating activities, add increases in current liabilities.

Cash Flow From Operating Activities: Explanation

This year your company decided to sell the land and instead buy a building, resulting in the following transactions. Assume your specialty bakery makes gourmet cupcakes and has beenoperating out of rented facilities in the past. You owned a pieceof land that you had planned to someday use to build a salesstorefront.

After adjusting the profits and losses, companies must report the proceeds under the investing activities. As mentioned above, however, these proceeds can only include compensation paid in cash. If a company receives non-cash compensation, it will not be a part of the cash flow statement. Companies can report proceeds on the sale of fixed assets in the cash flow statement as follows.

Specifics about each of these three transactions are provided in the following sections. Details relating to the treatment of each of these transactions are provided in the following sections. Specifics about each of these three transactions are provided inthe loss on sale of equipment cash flow following sections. Details relating to the treatment of each of these transactionsare provided in the following sections. In Example Corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $(260,000) + $90,000.